The Post Office has always stood for safe and secure investments in India. Among different small savings schemes, the National Savings Certificate (NSC) has become more popular because of guaranteed returns offered with government backing. Of late, the scheme has been buzzing that by making regular investments, an investor can earn nearly ₹58 lakh in 5 years.

What is the NSC Scheme?

It is a certificate issued to any person who deposits any amount along with that certificate stating or indicating the amount deposited on the fixed or variable repayment rate thereof for any fixed period. This is fully government-backed, making it perhaps the most secure investment option for risk-averse investors. The NSC comes with a fixed lock-in of 5 years and attractive rates of interest that are fixed and revised every quarter by the government.

How ₹58 Lakh Can Be Achieved

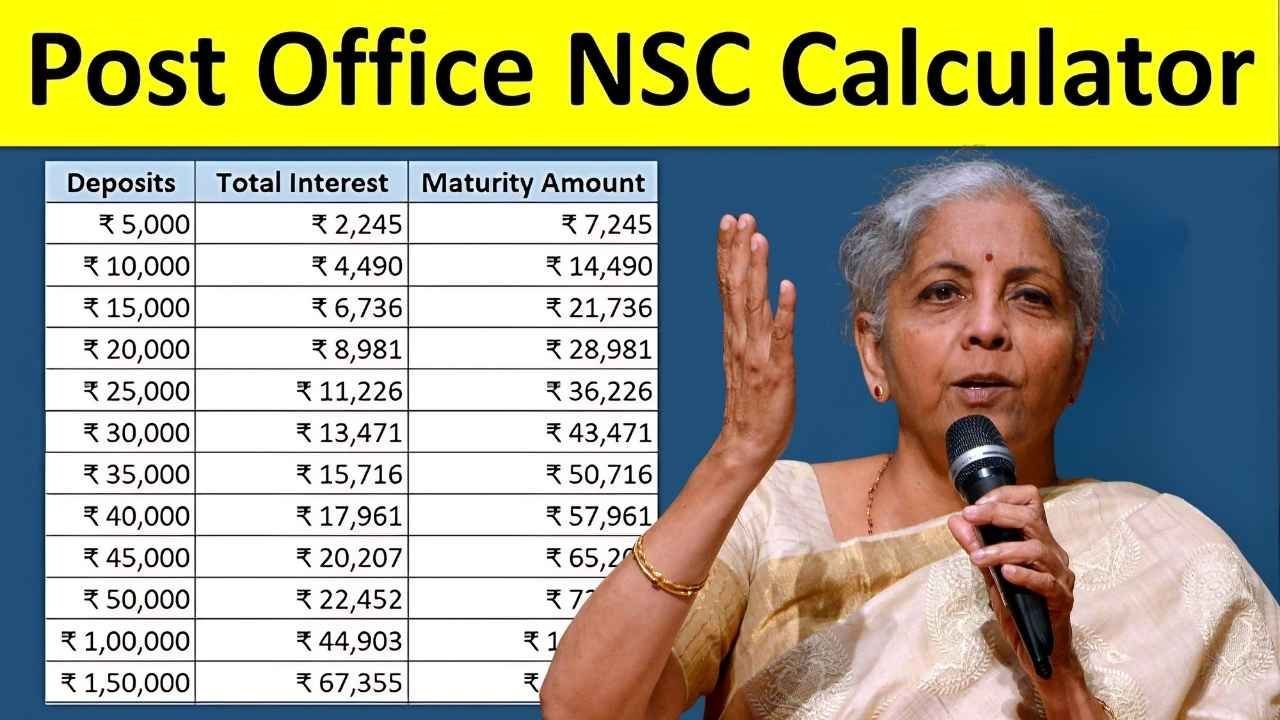

In this regard, the investor can accumulate large amounts of cash over the years. An investor who systematically deposits in NSC schemes, over a period of 5 years, can enjoy big multiplication over time. With compound interest favoring the investor, the maturity value may reach around ₹58 lakh at one time, depending on the amount and number of installments.

Key Features of NSC

- Minimum investment starts from ₹1,000

- No maximum investment amount

- Lock-in period 5 years

- Fixed interest rate attractive enough (decided by the government)

- Tax benefit under Section 80C of the Income Tax Act

Why Select NSC?

An NSC is suitable for an investor with a conservative approach who seeks guaranteed returns free from market risks. Unlike mutual funds or stock market options, the NSC provides the safety of capital with tax saving.

Who Should Invest in NSC?

- Salaried people seeking safe instruments for tax saving

- Parents wishing for a secure investment for their children

- Retirees looking for assured and steady returns

- People searching for government-sponsored schemes with assured benefits

Tax Benefits of NSC

NSC investment is eligible for deduction under Section 80C up to Rs. 1.5 lakh per annum. The interest on this amount earned is also compounded annually to increase the amount at maturity.

Conclusion

It is the Post Office NSC scheme that can be considered as perhaps the best medium to securely grow your money. By investing periodically, one can accumulate a huge amount of Rc 58 lakh in just a period of 5 years. Having assured returns, government backing, and tax benefits, NSC remains the strong avenue for safe wealth creation.