Since India Post offers FDs, they are the ideal instrument for the conservative types seeking guaranteed returns. As people are increasingly keen on planning their finances, the Post Office FD Calculator has become an indispensable tool. It allows investors to predict maturity amounts, interest income, or calculate investments smoothly and precisely.

Working of the FD Calculator

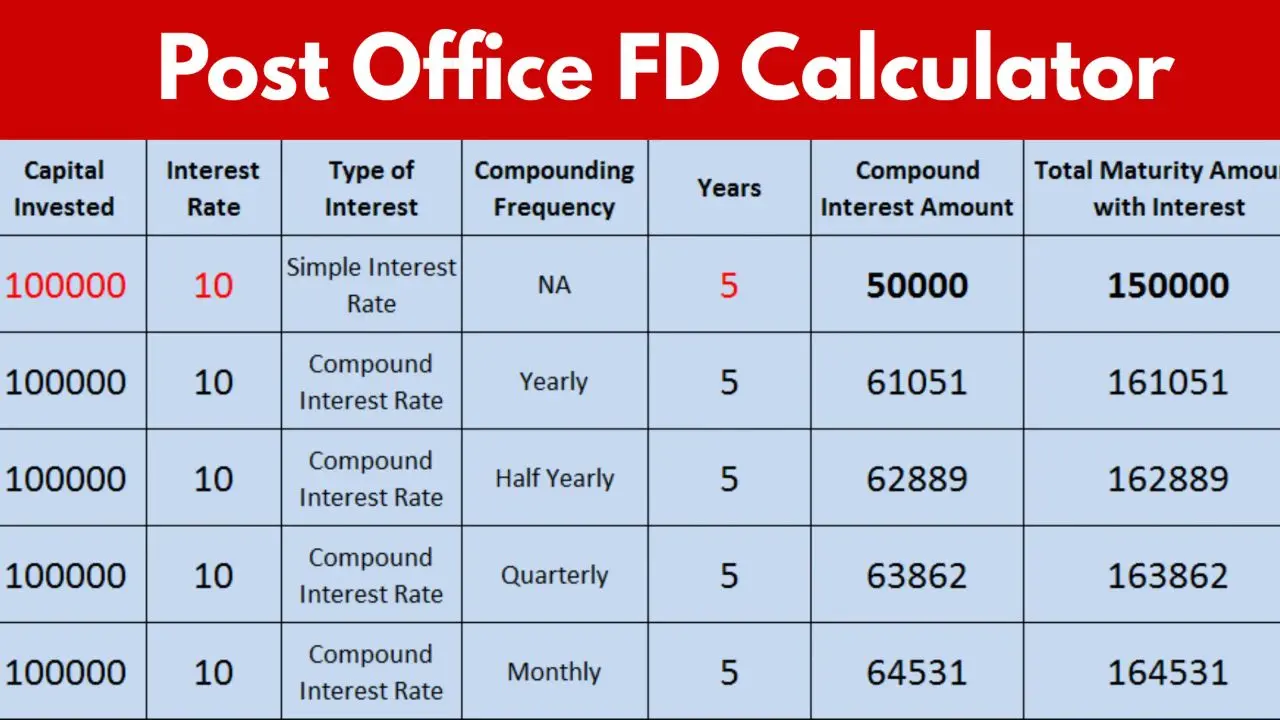

The Post Office FD Calculator facilitates financial planning. By entering the principal, tenure, and rate of interest, the calculator returns the maturity amount. The interest rates can be entered for both cumulative and non-cumulative FDs.

In the case of cumulative FDs, interest gets compounded and added to the principal, while with the non-cumulative scheme, the payouts are disbursed regularly, allowing investors to plan their monthly income accordingly.

Why Use the Calculator?

Since an FD calculator helps in making investment decisions, it will save investors the trouble of working things out manually and minimize any calculation errors, thereby projecting financial goals accurately.

Investors can swiftly juxtapose different schemes, choose a suitable tenure, and determine the investments that will fetch the desired return. This tool particularly favors retirees, salaried individuals, and other investors whose primary concern is capital safety.

Planning Investments Efficiently

These calculators help not only in visualizing the final amount of returns but in preplanning short-term and long-term goals. Investors can understand how little an amount grows over time and if necessary, could change interest rates or tenure. Consequently, they would plan for emergencies, retirement, and big expenses in a safe manner.

Why Consider Post Office FDs?

By the Government of India, Post Office deposits are considered absolutely safe for the capital. In conjunction with the FD calculator, these deposits act as infrastructures through which one can invest effectively and with full transparency. Through the use of the calculator, an investor can forecast earnings, plan cash flows, and optimize returns with minimum risk.

Conclusion

The Post Office Fixed Deposit calculator is really a handy and indispensable tool in investing with safety and strategy. Planning is eased, forecasts are enhanced with near accuracy, and combining it with Post Office FDs further add appeal. Such a calculator provides an easy double win for conservative investors looking for guaranteed returns and financial clarity.