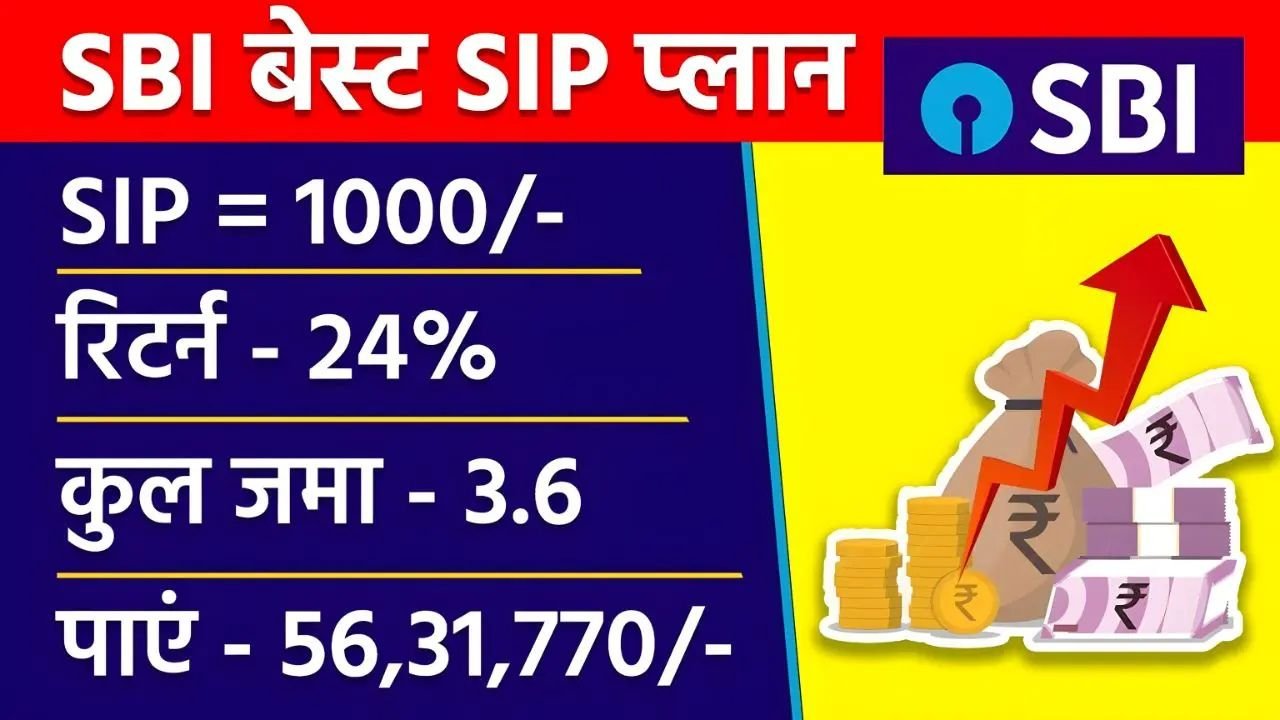

Investors today look for safe and smart ways to grow wealth without taking unnecessary risks. Among their top choices are Systematic Investment Plans offered by banks and mutual-fund houses. With the SBI SIP Plan, a small investment of just ₹2,000 per month can turn into a hefty ₹28.4 lakh over time, with the help of compounding.

What is an SIP?

A Systematic Investment Plan (SIP) is a way of investing money in mutual funds in which investors put in a fixed sum at regular intervals. This discipline apart from contributing towards wealth creation helps to average out the cost of investment, thereby minimizing the risks involved in market fluctuations.

How ₹2,000 Becomes ₹28.4 Lakh

If an investor continues to contribute ₹2,000 every month in the SBI SIP Plan for a long term of 25 years with ₹2,000 averaging 12% per annum, then the amount at maturity will be around 28.4 lakhs. This indeed shows the power of compounding where the mere compounding effect of even small amount investments can create a huge amount of wealth if invested regularly.”

Key Benefits of SBI SIP Plan

- One can start with just ₹500 per month

- Increase or decrease the amount being invested

- Long-term benefits due to compounding

- Time less risk

- Simple, disciplined, and automatic way to invest

Who Should Invest in SBI SIP Plan?

- Young professionals who intend to begin early and accumulate wealth

- Salaried persons who want a disciplined saving option

- Long-term investors for retirement or large goals

- Parents for children’s education and marriage expenses

Why Choose SBI for SIP?

The State Bank of India (SBI) is one of the country`s most trusted banks with multiple options for mutual funds. SBI SIP Plans have been formulated with different financial goals in mind, like retirement planning, education, and wealth creation, along with fund management that the investor can rely on.

Tax Benefits on SIP

Investment in SIP under some SBI Mutual Fund schemes (like ELSS – Equity Linked Saving Scheme) is eligible for deduction under Section 80C of the Income Tax Act up to ₹1.5 lakh in a financial year.

Conclusion

The SBI SIP Plan essentially shows how small savings put together regularly can create huge wealth over some time. By putting together a little as ₹2,000 every month, one can accumulate to ₹28.4 Lakh over the years, hence, forming a good vehicle.