Planning for retirement is one of the most important financial goals with an exceptionally prestigious status for fulfilling the **Employee Provident Fund (EPF) as a) means to build a significant corpus throughout a) life. Discipline towards contributions of just ₹5,000/month could build a fund of ₹3.5 crore over a lifetime, assuming monthly investment and compound interest at current EPF interest rates. The EPF Calculator 2025 are used by an investor to estimate the retirement corpus, all factors-governed by contributions made, tenure, or interest earned.

What Is EPF? Advantages of EPF

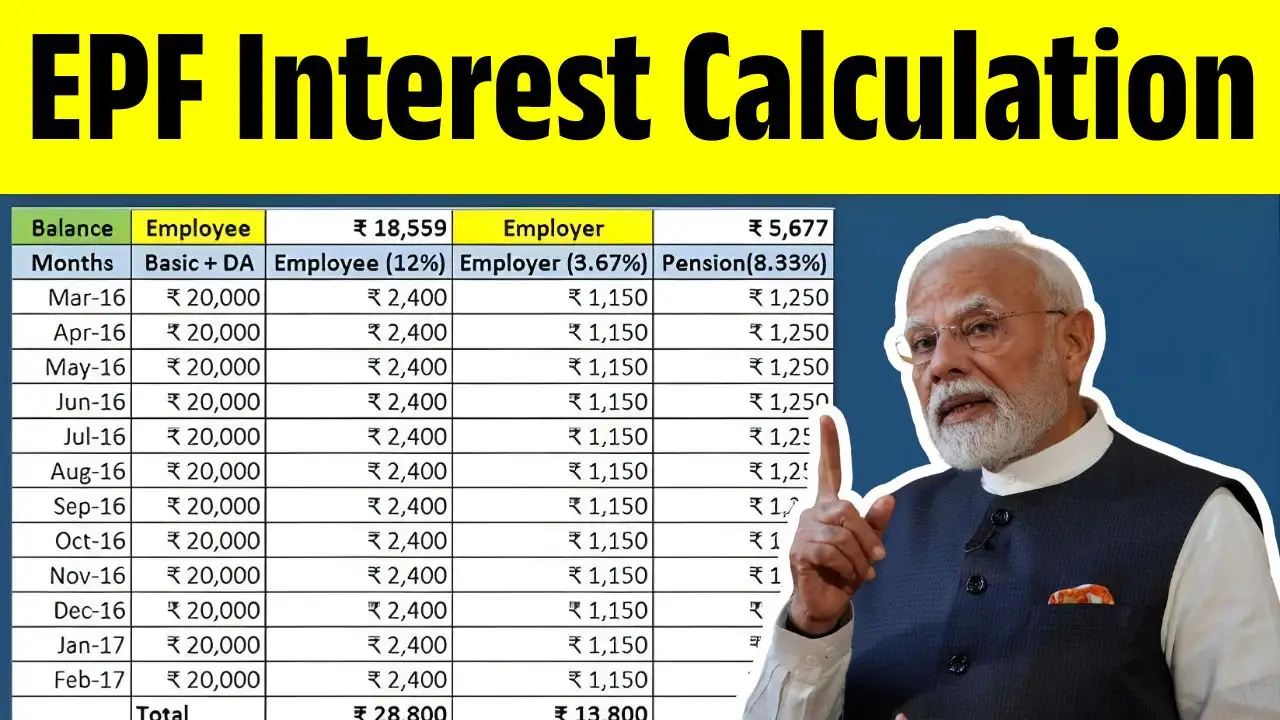

Employees’ Provident Fund is a retirement savings scheme for salaried persons provided by the government. A certain fraction of the salary from both employees and the employers is deposited every month into the EPF account, earning interest annualized at rates that the government announces. It is a safe and disciplined avenue of investment from which tax benefits are given under Section 80C. Fields arise off contributions and compounding for several decades, giving one an enormous corpus at retirement.

How ₹5000/Month Turns Into ₹3.5 Crores

Assuming an employee puts in ₹5,000 per month and matching contribution from the employer is allowed with an annual interest rate of 8%, the total corpus in EPF can shoot up significantly during 30 to 35 years of working life. In contrast, compound interest ensures that the interest earned during the year is also subjected to returns in the ensuing year, which works wonders in exponentially increasing the corpus over a period of time. The EPF Calculator 2025 allows an employee to try out different scenarios by altering the amount of contribution or tenure to get an idea of the expected corpus value on retirement.

| Monthly Contribution | Tenure | Interest Rate | Total Corpus |

|---|---|---|---|

| ₹5,000 | 35 Years | 8% per annum | ₹3.5 Crore (Approx.) |

Advantages of Using EPF Calculator

The EPF Calculator enlightens retirement planning by estimating the corpus by present contribution patterns. It enables employees to take certain decisions such as raising membership contribution or making voluntary contributions to increase accumulation for retirement. By seeing the time-wise build-up of savings, they can chart their way to post-retirement money securitization.

How to Maximize EPF Returns

To maximize EPF returns, complete the timely contributions. Additionally, one should execute extra payments voluntarily called a Voluntary Provident Fund (VPF). The interest rate’s announcement should be followed, and each year’s contribution should be kept constant for better long-term planning. Also, combining EPF returns with income via other instruments such as National Pension Scheme (NPS) can further enhance one’s financial security.

Conclusion

Employees can build a pension corpus of ₹3.5 crore by saving diligently monthly of ₹5,000 and with compounding interest. Using the EPF Calculator, individuals can plan adequately and adjust their contributions accordingly, ensuring secured and comfortable retirement. For a salaried person, EPF is probably the safest and most rewarding vehicle to build long-term wealth.