The Post Office has always been a safe haven for investments in India. To keep this tradition alive, India Post has come up with the India Post RD Scheme 2025, specially meant for small investors. With this scheme, one can begin saving something as little as ₹1,000 every month and secure their financial future with handsome returns.

What is India Post RD Scheme 2025

The India Post RD Scheme is a kind of fixed-term deposit plan in which the investor deposits a fixed sum every month from one month to five years. Upon maturity of the instrument, the investor is paid all deposits and interest earned at a very attractive rate, thereby making it one of the safest savings options in the country.

Features of India Post RD Scheme 2025

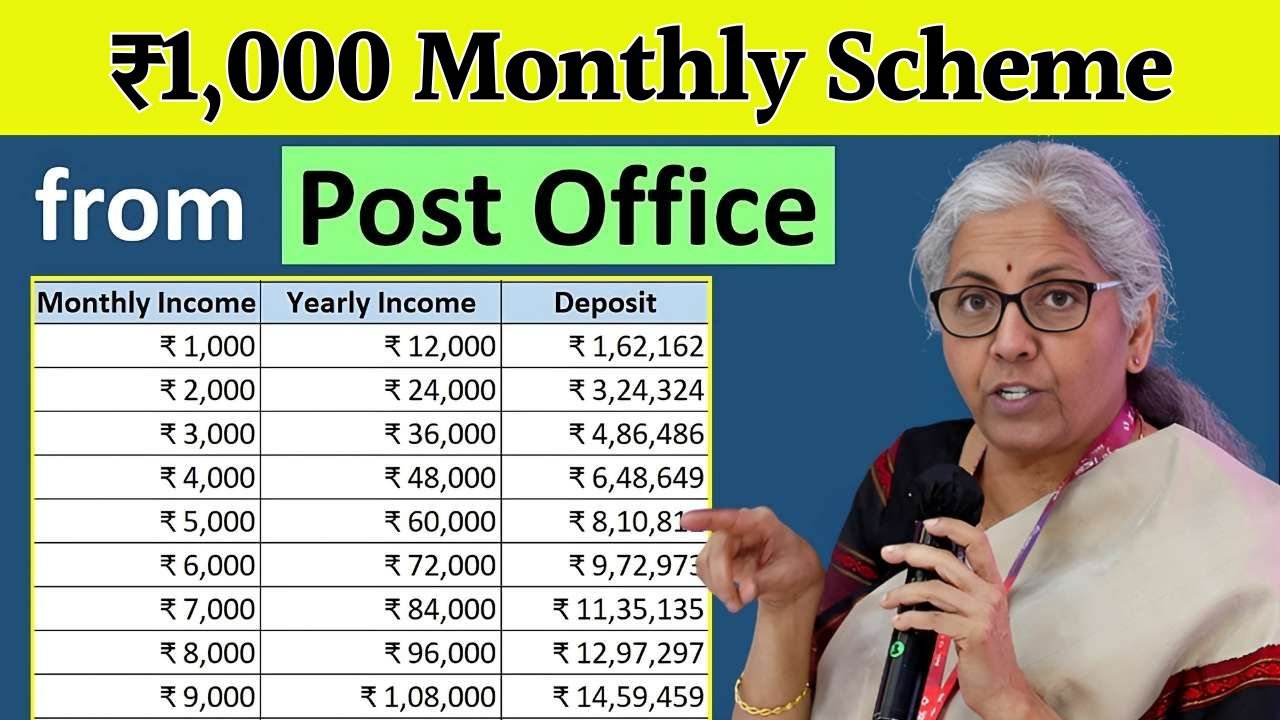

If you deposit ₹1,000 every month under the India Post RD Scheme, you will earn quarterly compounded interest. Gradually, over five years, your accumulation will gain momentum with handsome returns at maturity. The scheme can also be continued for benefits beyond five years.

Benefits of the Scheme

It is wholly backed by the Government of India, in other words, safe. Investors get guaranteed returns with zero market risk. It is the best-known avenue for anyone who wants to cultivate a habit of regular saving while clockwise watching his money grow. Senior citizens can also avail of this scheme to create a secure retirement corpus.

How to Open the Account

To open an India Post RD account, one should visit a nearby post office. The account may be opened either in individual name, jointly with someone, or on behalf of a minor. One will be required to submit basic KYC documents and pay the first monthly installment. Online services are also available in many post offices, which facilitate the doing of this business.

Conclusion

Therefore the India Post RD Scheme 2025 is an apt and reliable investment scheme for the small savers. By investing as low as ₹1,000 per month, the investor can grow the money into a handsome amount at maturity. This scheme suits the ones who want financial security without taking risks.