Indian Post Offices, for long, have been considered a secure means for savings and financial planning. In 2025, the Post Office came about with a fresh investment scheme to guarantee safety with decent returns and provide good flexibility to the investor. Hence, the scheme caters to the needs of equally conservative investors and those willing to save over the long run for a financial goal, such as retirement, education, or wealth.

About the New Plan

This new plan infuses investment with a guarantee of fixed returns within a given time frame. Such security ensures that the invested sum cannot diminish with growth. Contrasting with market-linked instruments, the scheme places foremost emphasis on safety and stability. That is why this scheme should appeal to conservative investors. The plan has a minimum investment, allowing everyone to participate-the really small investor and the large-scale investor.

Key Features of the Plan

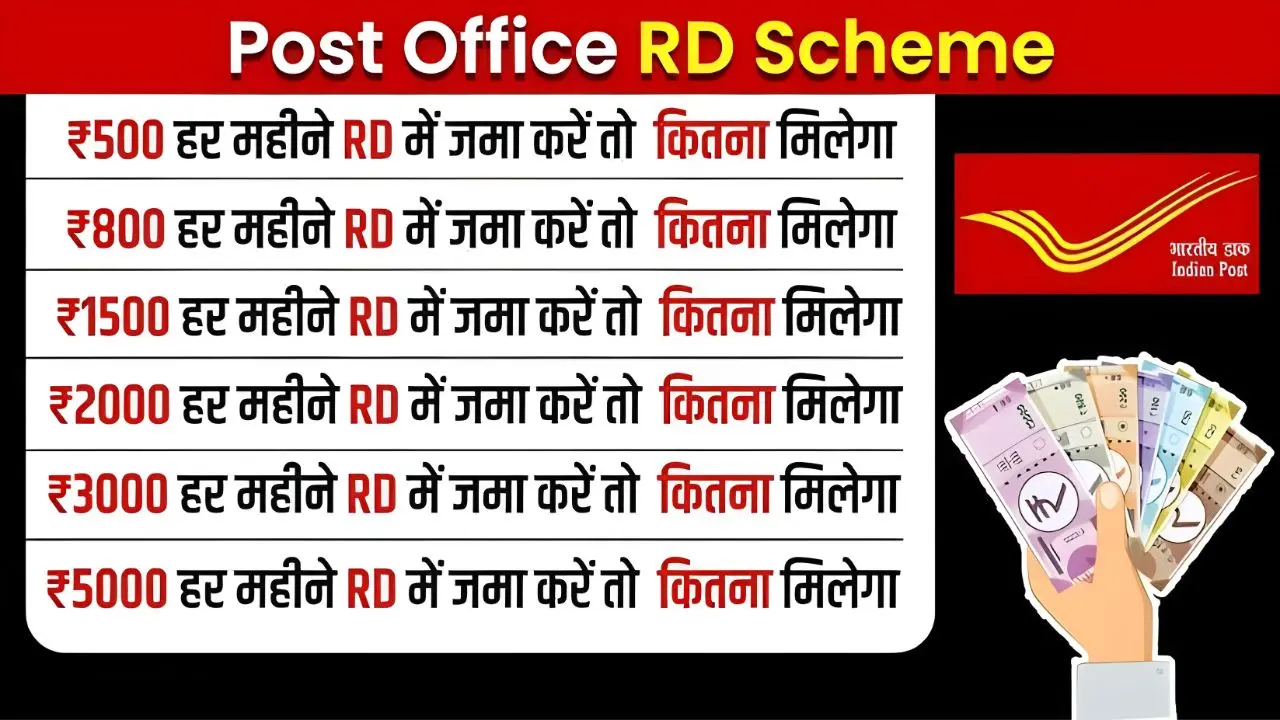

The main attraction for the new scheme is always the assured returns. Investors can select from various terms depending on the liquidity they want-from short to long-term investments. Deposit amounts are flexible; the investor can start with a small sum and increase his/her contribution later. This makes it possible to customize this scheme according to one’s economic background and liquidity needs.

Returns and Benefits

The plan offers an interest rate competitive with regular savings accounts and other conventional instruments. The interest is compounded a periodical way, thus promoting the growth of the corpus over time. There might be marginally higher interest rates for senior citizens as part of its inclusive framework. These guaranteed returns flow nicely along with the security from a government-backed institution, crafting a good-promising avenue for conservative investors seeking steady growth.

Safety and Reliability

The money earned under the Post Office new plan is backed by the Government of India, which comprises an assurance for the safety of the principal amount; Hence, it is categorized as a low-risk option, especially suitable during periods of heavy market volatility. The plan’s reliability and transparency further add to investor confidence, strengthening Post Office’s standing as a trustworthy institution for financial planning purposes.

Tax Benefits and Accessibility

Depending on the specific variant of the plan, investors could enjoy tax exemptions under Section 80C of the Income Tax Act. From opening to deposits, the plan can be opened and operated through any branch of the Post Office in the country, thereby appealing to investors from either cities or villages, since there are no complicated procedures nor formalities involved.

Conclusion

Thus, combining safety, flexibility, and sound returns, the new Post Office investment scheme of 2025 is the one to watch. Besides government guarantee, growth assured, and tax allowance, it is best for very conservative investors who want to play it safe with their money yet secure a reasonable return on their savings. Be it retirement, education, or wealth creation, all aims can be met with this plan.