Post Office Recurring Deposit (RD) Scheme has been one of those investment options for small savers in India for long. Implemented way back in 2022, under this plan, one is meant to deposit a fixed amount every month and earn guaranteed interest on it. Till 2025, the plan attracts individuals eager for a safe, disciplined, and government-backed instrument for savings.

About Post Office RD Plan

The RD scheme permits investors to deposit a fixed amount monthly for a predetermined span, usually between one and five years. This setup inculcates the habit of disciplined saving with assured returns at the end of maturity. Being a government-backed scheme, complete safety of principal and interest is guaranteed, making this scheme suitable for the very conservative investor.

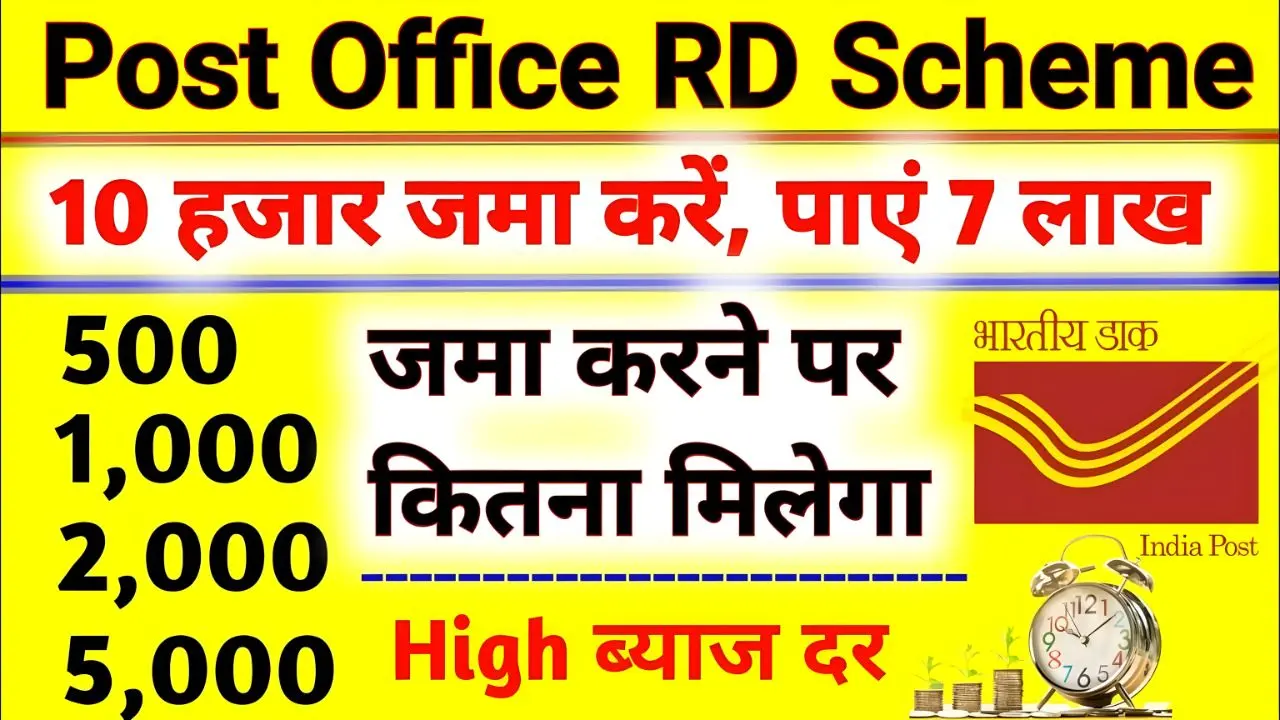

Interest Rates of Post Office RD

The interest rate for RD was about 6.7% per annum in the year 2022 and compounded quarterly. The interest is credited at the time of maturity, combined with the deposit itself, hence providing a greater effective yield.

The rates continue to remain competitive even for the year 2025, making small investors hold onto their trust of a reliable and predictable income source. The continuous interest crediting under the scheme acts as an incentive beside investing in conventional savings accounts.

Procedure Behind RD Post Office Scheme

Setting up an RD account requires a minimum monthly deposit that one can increase depending on one’s capacity to save. The scheme provides the facility of premature withdrawals after a year, albeit on reduced rates of interest. The flexibility in tenure and monthly deposit structure makes it apt for keeping money away for salaried folks, homemakers, and retirees.

Benefits Under an RD Scheme of the Post Office in 2025

The RD scheme assures returns; there is, hence, a guaranteed security for the amount invested while providing the convenience of monthly deposits. An eligible investor can use a simple RD calculator to estimate the maturity value based on monthly contribution, interest rate, and tenure. Additionally, the scheme gives tax benefits under Section 80C for eligible investors, making this scheme more attractive as a long-term savings option.

Even with meagre monthly contributions, the RD Post Office Scheme in 2025 offers a chance for them to grow into a respectable corpus, thus providing a reasonable, disciplined approach in fostering financial growth.