Important updates have now been announced by the government, regarding the retirement ages in public and private sectors. This measure speaks of demographic hopscotch, elevating workforce participation, and guaranteeing adequate financial support to the aging individual. There are several implications of the new set of rules for workers, employers, and pension schemes.

Who Will Be Affected?

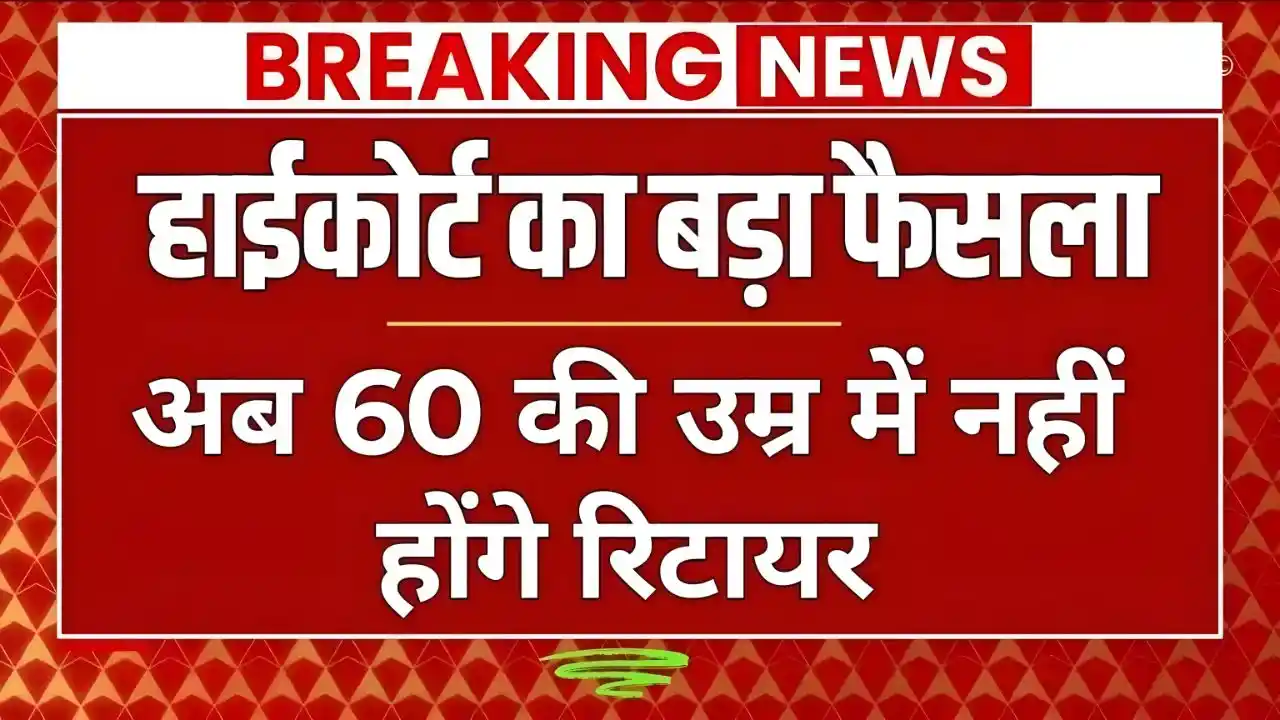

It is employees of the government services and certain private organizations that follow age rules similar to those in government services who are affected most by the retirement age hike. According to the amended rules, the new retirement age is 65 years compared to the earlier 60 years. Employees about to enter retirement should study this change made to pension benefits, provident fund contributions, and long-term financial planning.

Implication on Pension and Benefits

An application of a retirement age increase will be for the pension schemes and retirement benefits from those higher ages. With a later retirement, an employee would continue to contribute more years into provident funds and pension schemes, thus raising the level of accumulation and larger payouts after retirement. Pensioners, on the other hand, could become beneficiaries of withdrawal delaying just after gaining an opportunity to protect their interest before entering into retirement.

Transition and Implementation

The government has clarified that the gradual implementation of the new retirement age is a smoothing-out mechanism toward transition. Such employees who will be nearing retirement could prefer to elect retirement under the old scheme, or extend it through the new retirement age. Organizations would have to go about updating their HR policies, pay systems, and retirement planning tools so that calculations for all benefits are made accurately.

Bigger Impacts

Raising the retirement age has economic and social backdrops. It allows an experienced workforce to be held for longer, creating interludes for talent and then maintaining its productivity levels. For an individual, it denotes an opportunity for prolonged earning, saving, and being in the labor force. It also means the requirement of making good healthcare, work-life aspects during the long periods of employment.

Closing Thoughts

The update in retirement age hike in 2025 marks a major watershed in the world of work and retirement policies. On the one hand, it guarantees financial and professional benefits to employees, while on the other, it puts organizations and individuals in the position to modify their planning. Understanding this is imperative in making good career, retirement savings, and other long-term security decisions.