SIP, if I say, is one of the best-known methods for building wealth over time. SIP simply means investing a fixed amount of your saving at regular intervals. But if adequately disciplined in investing and the power of compounding are harnessed for good, even a small amount of monthly investing will amount to large sums. SBI Mutual Fund considers itself an investor-friendly fund house, offering various SIPs that allow investors to earn ₹28.4 lakh by investing as low as ₹2,000 monthly over a period of a couple of decades, thus making it viable for anyone-whether beginners or seasoned investors.

Reasons to Choose SBI Mutual Fund SIPs

SBI Mutual Fund enjoys a reputation for sound portfolio management with transparent processes and consigned fund performance. SIPs provide the advantages of rupee cost averaging coupled with discipline in investing that helps to cushion against market volatility. Investing a fixed amount at regular intervals allows investors to build a reasonable accumulation corpus gradually, without worrying about timing the markets. These features make SIPs well suited for long-term financial objectives.

Growth Under The Monthly Invest to ₹2,000

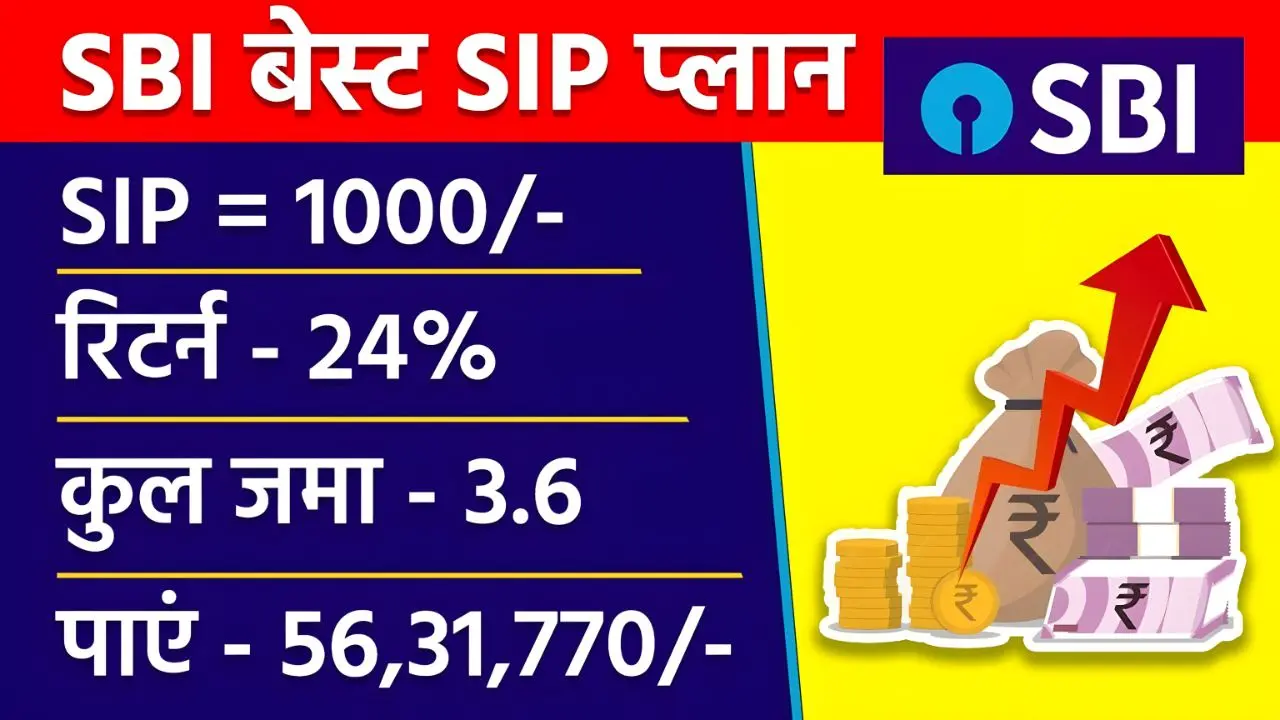

Assuming a hypothetical average annual rate of return at 12%, investing ₹2,000 per month through an SBI SIP for 30 years would grow to an estimated ₹28.4 lakh. This scenario is a great illustration of how long-term investing and compounding come together to maximize wealth creation. Stay early, stay late, and have stay regular. These add to your returns. Extra time generally means more wealth-building opportunities, no matter how little the monthly investments may be.

Top SBI SIP Plans To Consider

SBI offers SIP plans for each risk category. The SBI Bluechip Fund, for a more conservative investor, invests in very large-cap stocks and may provide stability with moderate growth. An aggressive investor can submit an application for the SBI Small Cap Fund or SBI Magnum Midcap Fund; these have greater growth prospects but also more volatility. Beware of the balanced investor who may want some risk and return-they can consider SBI Equity Hybrid Fund which gives hybrid exposure between equity and debt.

Tax Benefits and Flexibility

SBI SIPs like Equity Linked Savings Schemes (ELSS) may be eligible for deductions under Section 80C, practically increasing their appeal. Another advantage SIPs offer at this time, while making flexible contributions at a monthly or quarterly basis, can also allow top-ups, giving the option to pause investments if the situation so demands. This keeps them very moldable to investors’ current change of financial goals and circumstances.

Conclusion

Mutual Fund SIPs of SBI provide for a rational and disciplined method of wealth creation over time. Investing just ₹2,000 per month can, with steady investment, very well become ₹28.4 lakh over several decades. Due to the diversity of fund choices, tax benefits, and compounding, SBI SIPs will continue to be smart choices for individuals interested in securing their financial future and achieving significant wealth creation in 2025 and beyond.